How To Find Option Plays

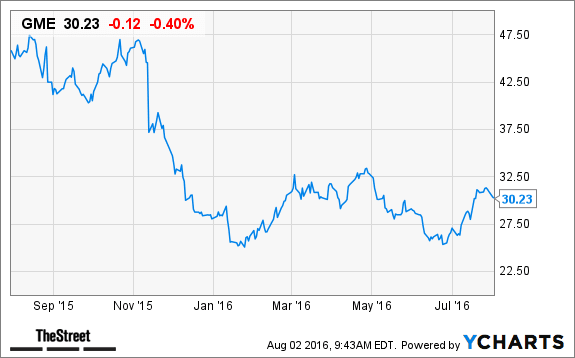

Pokemon Go has put the spotlight onGamestop (GME) - Get GameStop Corp. Class A Report . The physical retailer of video games had nothing to do with the alternate reality sensation, but branded itself as a place for Pokemon hunters to congregate. Of course, the stock reacted and it is up significantly. However, that is not the only reason to look at Gamestop.

Let us take a look at its balance sheet. The company has debt of $812 million. This is reasonable compared to its total assets (net of current liabilities) of $3 billion. However, it is high compared to the total tangible assets (net of current liabilities) of just over $1 billion.

Another way to look at the debt is to see its interest servicing capabilities. These seem to be quite strong given the level of debt. The interest cost is about $50 million per annum compared to annual operating profit of about $500 million to $600 million, conservatively. Revenues are stable for last few years at $9 billion, generating a net profit of $300 million to $400 million.

The stock, despite a nearly 18% run-up in the last few days, is available quite cheap based on typical price multiples; the price-to-earnings ratio (PE) is at 8.25. Even adjusting for the debt and cash, the adjusted PE is less than 10. That gives an earnings yield (inverse of PE) of 10% to 11% each year. The EBIT yield is nearly 18% every year. It currently, sports a dividend yield of 4.7%. This makes it look quite cheap and a good security to earn income.

Now the most important factor is whether the company can maintain its revenues, profits and dividends. If it can maintain its profits and dividends it would be a great bargain. If it could also grow its profits and dividends it would be an exceptional bargain.

TheStreet Recommends

ArthVeda's Smart Aleph framework (disclosure, I am chief investment officer at investment firm ArthVeda Capital; I and ArthVeda's clients both own Gamestop) is confirming this status of an exceptional bargain since Gamestop is showing up on multiple Smart Aleph strategies. It is showing up in Smart Dividend total-cap 50 (AUTD), as part of the top 50 from the universe of the largest 1500 stocks. It is also showing up in Smart Xtreme mid-cap 50 (AUMX), as part of the top 50 from the universe of midcap stocks.

Now let us look at where the revenues are coming from. Currently, there are four segments: physical video games (the traditional business of Gamestop) contributing $8 billion' digital (the downloadable video games) contributing $1 billion, or so; technology brands (mostly selling mobile phones, media players etc.) contributing just short of $1 billion; and collectibles contributing $0.5 billion, but expected to grow quickly to a billion.

While revenue from physical video games continues to be dominant at about 80%, the operating earnings from the other segments are already at 30% of the total. The earnings from these segments are projected by management to grow to about 50% of the total company operating earnings. This clearly shows the management's consciousness of and efforts to diversify the revenue and earnings streams.

The traditional physical video gaming segment could potentially get a new stimulus from the entrance of augmented and virtual reality products and technology. The physical retail gaming store could gain back importance as a place to learn about the new technology, try demonstrations and compare competing products. Depending on the product sophistication it might require help from store assistants.

Further, Gamestop's Powerup Rewards program has 46 million members worldwide. Many of these are likely to be heavy-duty gamers with strong passion for gaming in traditional video games; but they also would be likely to migrate in significant numbers to any new technology, like virtual reality or augmented reality. The rewards programs also nudge these users to continue buying new products, such as collectibles and digital/mobile games from Gamestop.

Overall, it looks like the company is reasonably poised to maintain its revenues, profits and dividends for the next few years. However, as the Pokemon Go effect showed in the last few days, a significant upside surprise from virtual reality or augmented reality could occur to the holder of Gamestop stock. However, these are likely to accrue substantially to an investor with a two-to-three-year holding period.

The author and clients of ArthVeda Capital hold Gamestop. See ArthVeda Capital Disclaimer.

How To Find Option Plays

Source: https://www.thestreet.com/opinion/gamestop-is-a-value-play-and-a-call-option-on-augmented-reality-13658539

Posted by: yountshareade.blogspot.com

0 Response to "How To Find Option Plays"

Post a Comment